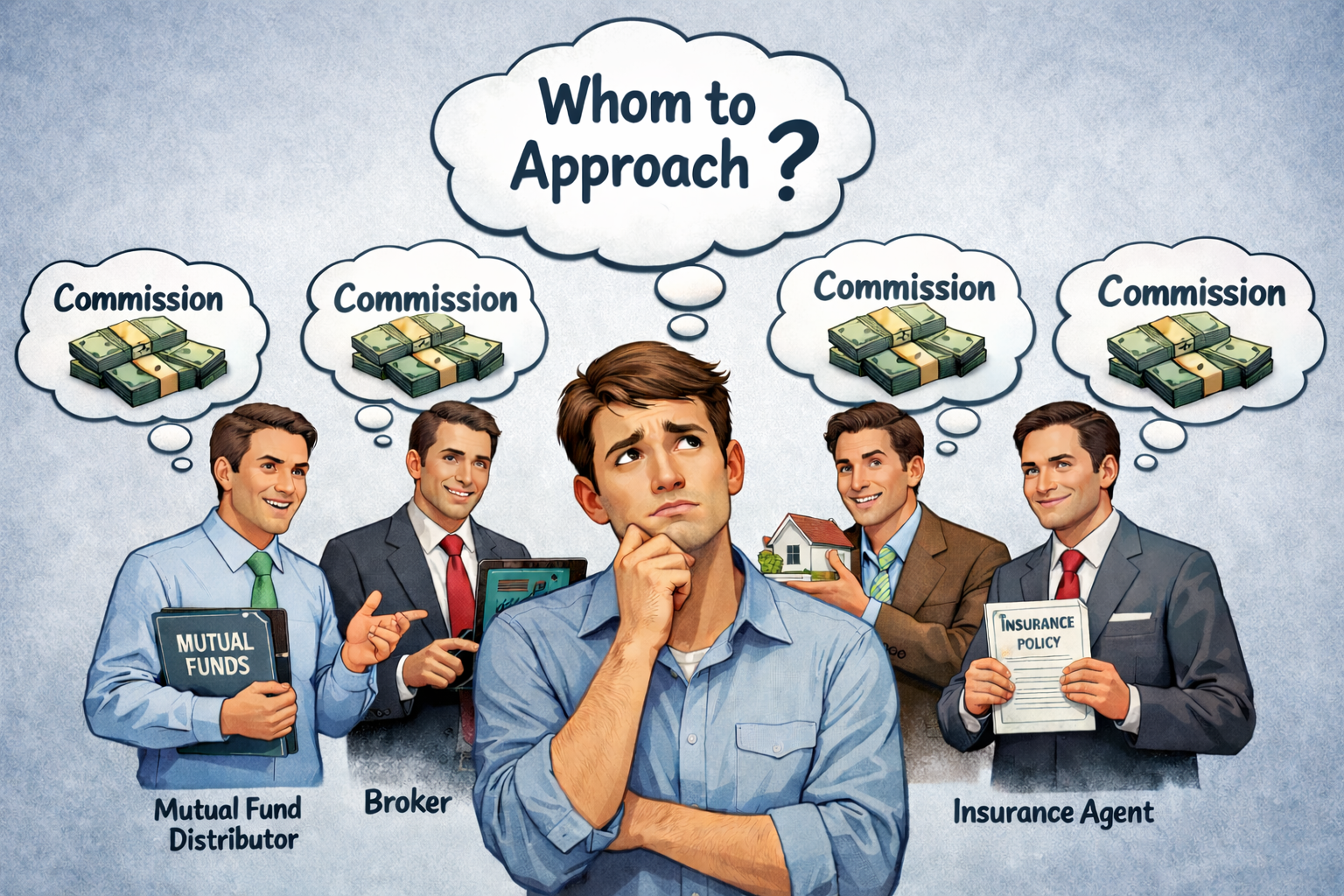

“Don’t ask the barber if you need a haircut.” — Warren Buffett

This quote perfectly captures the inherent conflict of interest when financial advice comes from product-based financial advisers.

These include mutual fund distributors, insurance agents, stock brokers, real estate brokers, loan agents, and even bankers.

Their income depends on only one thing: you buying a financial product.

Which means the advice, however well-intentioned, can rarely be contrary to the sale — because that would affect their revenue stream.

To be clear, most of these intermediaries do a commendable job. But you should approach them only when you are very clear about what you want from that specific product category.

For example:

• An insurance agent will predominantly recommend insurance products (and often, there are more investment products in insurance than pure insurance products).

• A mutual fund distributor will naturally focus on mutual funds.

• A broker will encourage market participation.

• A real estate broker will speak about property opportunities.

This is natural. This is how their profession is structured.

But you are not a product.

At Naveen Rego Capital, we believe:

• You are a person with financial goals, aspirations, anxieties, emotions, and fears.

• Financial products are merely tools to achieve outcomes — they are not the outcome itself.

Who should you approach then?

If you are completely sure of what you want, a product-based adviser is perfectly fine.

But if you are unsure…

If you want an unbiased discussion…

If you want guidance that is not linked to any sale…

Then you should approach a fee-only financial planner.

These professionals are registered as SEBI Registered Investment Advisers (RIA) and are very few in number. Their fees are not contingent on selling any financial product. They are paid purely for advice and planning.

A fee-only planner builds a roadmap based on your life, your finances, and your goals — not based on what needs to be sold.

The Bottom Line

If you know the product you need — go to a product expert.

If you want to protect your wealth and make the right decisions across products and financial goals— go to a conflict-free fee only financial adviser.

Happy Financial Planning!

Naveen Julian Rego – CFP®

MD & Principal Officer

Naveen Rego Capital

SEBI Registered Investment Adviser

Reg No: INA000019211

BSE Membership ID: 2178

Date: 11-02-2026

Disclaimers:

1. Investment in the securities market is subject to market risks. Read all the related documents carefully before investing.

2. Registration granted by SEBI, membership of BSE and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

3. Financial products recommended by us which are under the jurisdiction of other regulators are beyond the scope of SEBI’s grievance mechanism.