Recently, one of our clients was unhappy that his long-term portfolio returns were about 2% p.a. lower than the equity market.

On further discussion, we realised that 40% of his portfolio was intentionally kept conservative for an impending goal — his daughter’s marriage — which, as of now, has still not materialised.

So, the question was:

Should we have put the entire corpus into equity to earn that extra 2% p.a. and risk the marriage goal?

Or was the conservative allocation the right decision, even if it meant lower returns?

This is the price of asset allocation.

At Naveen Rego Capital, our view is very clear:

Portfolios are created to fund financial goals at the right time — not to show off higher returns.

There is no use of higher long-term returns if, when the money is actually required, it is trapped in a severe market downturn.

Higher returns look great on fact sheets.

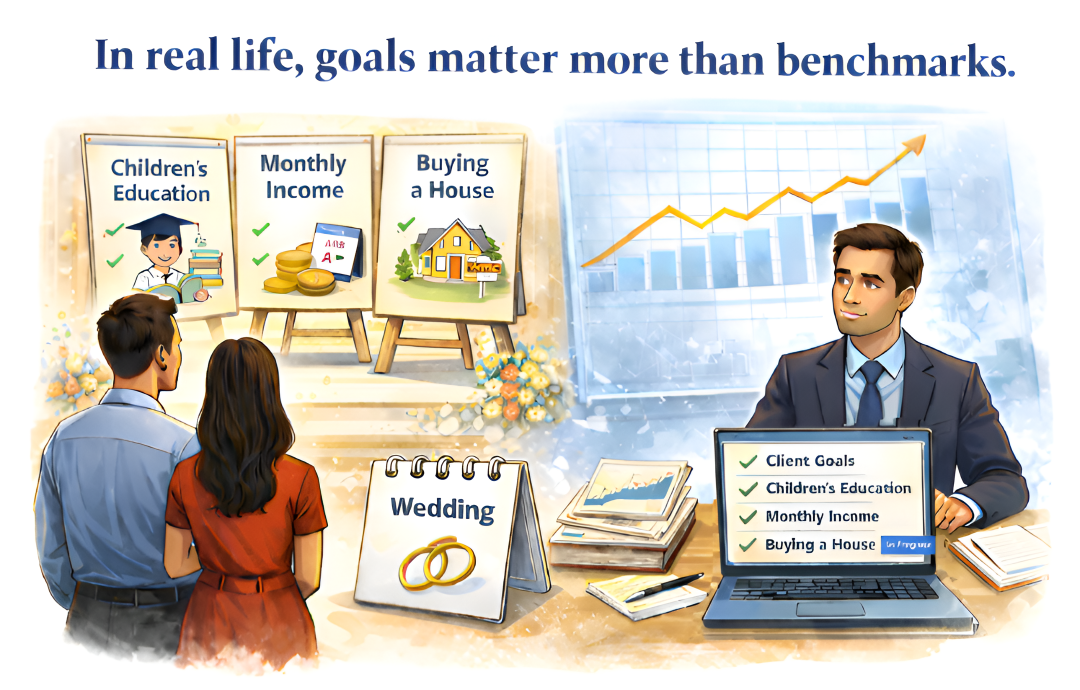

We help our clients sleep peacefully, knowing their financial goals will be funded with minimum volatility — whether it is:

- Children’s education

- Regular monthly income

- Buying a house

- Or any important life goal

Because in real life, goals matter more than benchmarks.

Happy Financial Planning!

Naveen Julian Rego – CFP®

MD & Principal Officer

Naveen Rego Capital

SEBI Registered investment adviser

Reg No: INA000019211

BSE Membership ID: 2178

Financial Planning | Investment Advisory | Wealth Management

Date: 07-01-2026

Disclaimers:

1. Investment in the securities market is subject to market risks. Read all the related documents carefully before investing.

2. Registration granted by SEBI, membership of BSE and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

3. Financial products recommended by us which are under the jurisdiction of other regulators are beyond the scope of SEBI’s grievance mechanism.