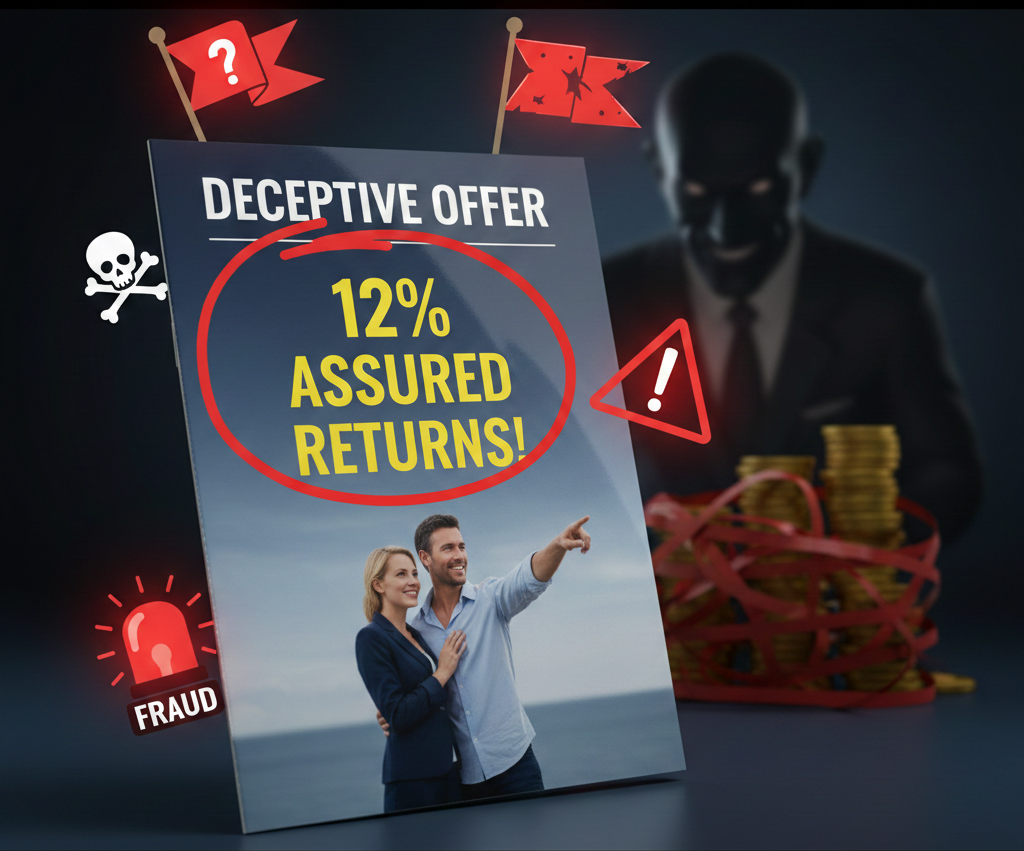

We had an interesting development of late. We were approached by a recently retired client who wanted to deploy his retirement corpus sensibly and securely. The surprising part was the “advice” he had already received: he had been told to invest ₹10 lakh per year for 5 years in a traditional insurance plan from a large PSU life insurer, with an assured return of 12% p.a.

The brochure he shared seemed to support this claim at first glance. He also mentioned that if he opted for a market-linked plan (he meant ULIPs), the returns would be “much higher than 12%.”

As a practising fee-only financial planner, this raised multiple red flags, prompting a detailed investigation.

What we found during our review

1. Missing regulatory disclosures

The brochure did not contain the standard IRDAI disclaimers, which are mandatory for all insurance products.

2. No IRDAI product code

Every approved Insurance product carries a unique IRDAI product code. This brochure did not mention it anywhere.

3. Missing mandatory 4% and 8% illustrations for traditional plans

Traditional participating/non-participating plans must provide benefit illustrations at 4% p.a. and 8% p.a.

These were completely absent.

4. Missing disclaimers for market-linked products

If a product is market-linked, clear disclaimers stating “returns are not guaranteed and are subjected to market risk” must be displayed. Again, missing.

The absence of these disclosures itself made the return projections highly questionable.

Our recommendation to the client

Considering the high costs, opaque structure, and low realistic returns of such traditional plans, we suggested two simple and transparent alternatives:

Option A: Plain-vanilla fixed-income solutions

• Bank deposits

• Senior Citizens Savings Scheme

• RBI Floating Rate Bonds

• Other government-backed savings schemes

These offer clarity, safety, and reasonable post-tax outcomes.

Option B: A balanced portfolio for inflation protection

A combination of:

• Low-cost direct index funds, and

• Diversified equity mutual funds

paired with a solid fixed-income base and the support of a fee-only SEBI Registered Investment Adviser for ongoing planning.

The broader lesson

If you approach a product seller-whether a mutual fund agent, insurance agent, relationship manager, or banker-please understand the inherent sales bias.

Products with high commissions will be pushed harder, regardless of whether they suit your needs.

Approach a SEBI Registered Investment Adviser (RIA) for unbiased, Fiduciary advice. Otherwise, you may end up working hard while someone else enjoys the rewards of your effort.

Strong Disclaimer

This article is for educational purposes only and not an investment recommendation. Please consult a qualified, fee-only financial planner for personalised advice.

Happy Financial Planning!

Naveen Julian Rego – CFP®

MD & Principal Officer

Naveen Rego Capital

Financial Planning | Investment Advisory | Wealth Management

SEBI Reg No:INA000019211 and BSE Membership ID:2178

Date: 03-12-2025

Disclaimers:

1. Investment in the securities market is subject to market risks. Read all the related documents carefully before investing.

2. Registration granted by SEBI, membership of BSE and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

3. Financial products recommended by us which are under the jurisdiction of other regulators are beyond the scope of SEBI’s grievance mechanism.