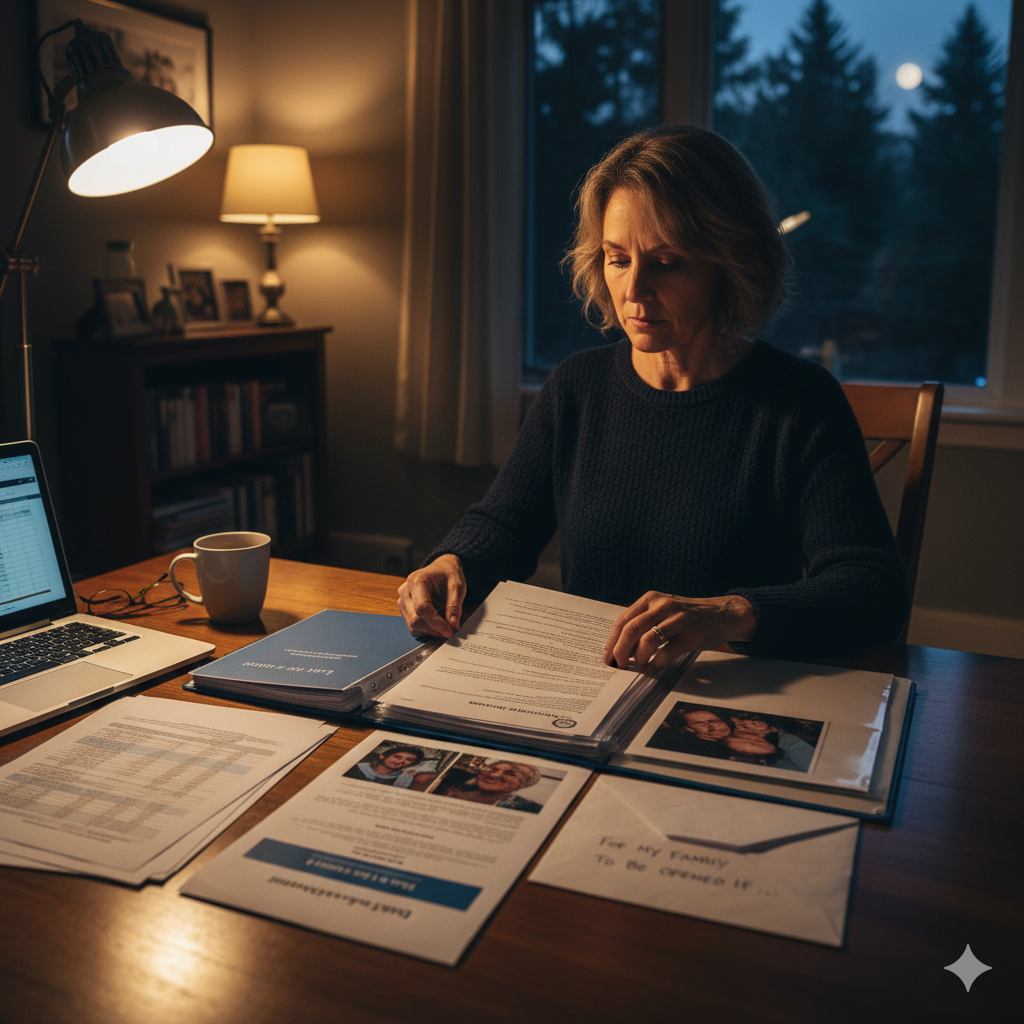

The recent Air India flight crash in Ahmedabad is a sobering reminder of life’s uncertainty. It made me reflect: Are my near and dear ones truly aware of my financial and other holdings? Do they know how to access them, or how to manage or distribute them if I’m no longer around?

For many, investment holdings, bank accounts, insurance policies, and property documents are scattered and disorganized. Often, even spouses are unaware or disinterested—until, unfortunately, they’re forced to deal with everything amidst trauma and grief.

Based on my years of experience, here are 10 practical suggestions to help ensure that your family is not left struggling:

1. Maintain a Comprehensive List: Document all your bank accounts, financial investments, and real estate holdings—review and update this list at least once every six months.

2. Consolidate: Reduce overlaps. You don’t need five bank accounts or six demat accounts—two of each should suffice. Likewise, don’t try to invest in every mutual fund or stock. Focus your investments.

3. Simplify Real Estate Holdings: For older individuals, it may be wise to reduce non-core property holdings—especially if your children are not interested. Financial assets are far easier to manage.

4. Keep Nominations Updated: Ensure that all nominations (bank, insurance, investments) are current and correct.

5. Share Key Information: Regularly share your consolidated document with a trusted family member or confidant.

6. Password Access: Securely store and share important passwords (mobile, laptop/computer, bank accounts, etc.) with a close confidant.

7. Joint Bank Accounts: Where possible, maintain joint accounts for quicker access to funds when needed.

8. Write a Will: Having a legally valid Will can save your family immense legal and emotional stress.

9. Work With a Fee-Only Financial Planner: A conflict-free, fiduciary advisor can be a valuable partner. Consider including them in your information-sharing loop.

10. Involve Your Spouse: Encourage your life partner to participate in regular financial reviews and meetings with your planner.

In the end, if your loved ones have to struggle to access your wealth, what was the point of it all?

Take the time now—it’s a gift of clarity, peace, and strength to those you care about.

Warm regards,

Naveen Julian Rego, CFP